The Power of Strategic Leveraging How to Generate Higher Returns with

Leverage Linked to System Performance

From Catalin Plapcianu’s Course

The Square: Quantitative Analysis of Financial Price Structure

Introduction

The importance of leveraging is not something that is fully understood by most traders as being a KEY component in the development of a trading system capable of producing spectacular returns like those demonstrated by W. D. Gann in his famous 1909 Ticker Interview. In fact, many traders do not understand that the ability to use higher degrees of leverage is based almost solely upon the degree of accuracy of the predictions generated by the system. When Gann’s associate, William Gilley stated:

“He has taken half a million dollars out of the market in the past few years. I once saw him take $130, and in less than one month run it up to over $12,000. He can compound money faster than any man I ever met."

This capacity to compound money at rates of 12,500% return in one month is only achieved through the exactitude of predictions coupled with an aggressive leveraging of account margin.

It should be clear there is NO market that is capable of moving 12,000% in one month. In fact, if you calculate the complete movement of every swing that occurs in the market, it will be found that most markets move approximately 70% per month. Therefore, if you caught every swing in the market, the maximum you could make would be only 70%. Since no one trades every complete swing, even if one captured half of each swing, this would only produce a 35% return, unleveraged. Therefore, the ONLY way that that such huge returns can be generated is by using extreme leverage. And in order to use extreme leverage, a trader must be able to take positions with precise accuracy and incredibly limited risk. The reason for this is that when using such extreme leverage, if one’s projections are not precise, the stop losses, even when very tightly placed, would be so large that only a few losses would quickly drain an account.

Therefore, an important element in the development of a trading system capable of producing returns in the 100’s to 1000’s of percent is the proper strategic use of leverage in one’s trading. And the degree of leverage is, by necessity, dependent upon the accuracy and precision of the signals or projections generated by the trading system. A system that generates less accurate signals, say within a 10-20% range of the price or time of an expected turning point must limit its risk by using little to no leverage. However, a methodology that produces highly accurate projections in both price and time, down to minutes and cents, will allow increasing levels of leverage in accordance to the percentage of accuracy of the system.

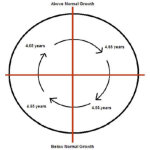

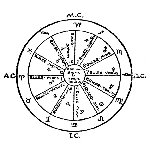

This is a key element in the development and use of the Hyperbolic and Circular algorithms presented in this series, particularly as they advanced through their 3 Levels of sophistication. The Hyperbolic algorithm, being a trend following system, is by nature not fundamentally seeking exact turning points, but is rather focused upon catching increasingly larger trend segments, so that one would not use the highest degrees of leverage with it. However, as it advances from the Hyperbolic 1 to Hyperbolic 3, the increasing functions coordinated across both price and time and then price/time, do significantly heighten the accuracy of its projections, allowing for an ongoing ramping up of leverage as the algorithm progresses to its more advanced stages.

At the same time, the statistical analysis features provided with the Hyperbolic 1-3 subscription Apps contribute to this leverage evaluation, since it is possible to determine specific risk parameters in different markets on different timeframes through backtesting, thereby allowing various appropriate degrees of leverage to be applied in different situations according to the statistical performance of the system. In the following Leverage Analysis, 5 markets have been selected from our prior Statistical Performance section, and a leverage analysis has been run on them demonstrating the results of each algorithmic application when run through 2 times, 5 times and 10 times leverage on the same trading signals. Following this summary, we have provided the actual trades generated in each of these cases for three of the sample markets, so as to give some detail of the difference in results and the capabilities of the algorithms when systematically applied.

Following the Leverage Analysis, are provided a set of account records demonstrating the results of actual real-time trading in the most advanced type of scenario. This uses the Circular 3 algorithm, the most advanced tool presented in this series, which is specifically developed to project very accurate turning points in both price and time. It is so exact that 3 out of 10 times it hits BOTH price and time EXACTLY! When it is not exact, another 4 of 10 times it is within 5% of the turning point in price and time. The final 3 occurrences fall farther outside these parameters and are considered misses.

When the algorithms perform with this level of accuracy, the leverage can be jacked up to extreme levels, like those used by W. D. Gann to produce the returns that he is so famous for. In the real-time trading records below, you will see that the account began with a mere 1000 Swiss Franc value, and was traded using 100 times leverage! Because of the precise accuracy of these projections, this massive leverage could be applied, using a stop loss in the currency markets of only 1 pip. Using this strategy, the Circular 3, which was NOT automated at that time, but was being traded manually, was able to produce a 1732% return in 5 months, turning a 1000 CHF account into 18324.38 CHF, a 4156.8% Annualized Return. This is a beautiful example demonstrating the power of these indicators when taken to their more advanced levels.

Hyperbolic 1 (Beta Version) Leverage Analysis

For these initial Level 1 indicators, we generally do NOT recommend using excessively high leveraging, though we will leave this determination to the level of experience and knowledge of the trader. As this series progresses, the Hyperbolic and Circular indicators on Level 2 and Level 3 will become more precise and efficient, allowing more highly leveraged positions to be safely taken with these more advanced indicators. However, even with the Level 1 indicators, in many cases leveraging 2x will work fine without significantly increasing risk, while producing double the returns. And in some cases, even higher leverage can be relatively safely used, according to the statistical results provided by the backtesting.

The following analysis and study of these variations is provided to help traders better understand the results of using different degrees of leverage when trading the Hyperbolic 1 algorithm. The primary factors required to determine the viability and degree of leveraging are the number of consecutive losses, or Loss Run, and the Maximum % Drawdown variables shown in the far right columns of the Statistical Performance section. As will be seen below, the smaller the Maximum % Drawdown, the higher the leverage possible, and the larger the % Drawdown, the less desirable it is to leverage the system. With this in mind, it is prudent to backtest longer data sets in order to determine probable drawdowns over extended periods.

We will give examples of three of cases below, the first showing a small maximum % drawdown (0.84%) in the USDJPY, then a mid-range drawdown (3.99%) with Google, and an extremely high drawdown (25.64%) in Facebook. It will be seen with the Facebook example that leveraging the account above 2x wiped out the entire account, exactly the situation we most want to avoid. The table shows a sample of 5 markets from Appendix 1, along with the results of trading them for the defined backtest period using a 2x, 5x, and 10x leverage factor. We will illustrate the 3 cases mentioned above just to show the potential positive and negative results which can occur using these various levels of leverage with the Hyperbolic 1 algorithm.

Hyperbolic 1 (Beta): Leveraged Returns

Summary of total returns across 5 markets using 3 different leverage factors(2x, 5x, 10x):

JPYUSD Leverage Study

- 60 Minute Interval

- 3 Month Backtest

- Total Profit in 3 Months Non-Leveraged = 7.1%

Total Returns with 3 Increasing Leverage Factors – Trade Details 3 Month Returns:

- Chart 1 – 2x Leverage = 14.6%

- Chart 2 – 5x Leverage = 39.4%

- Chart 3 – 10x Leverage = 89%

Google Leverage Study

- 15 Minute Interval

- 2 Month Backtest

- Total Profit in 2 Months Non-Leveraged = 33.4%

Total Returns with 3 Increasing Leverage Factors – Trade Details – 2 Month Returns:

- Chart 1 – 2x Leverage = 73.3%

- Chart 2 – 5x Leverage = 264.4%

- Chart 3 – 10x Leverage = 944.6%

Facebook Leverage Study

- Daily Interval

- 23 Month Backtest

- Total Profit in 23 Months Non-Leveraged = 208.1%

Total Returns with 3 Increasing Leverage Factors – Trade Details 23 Month Returns:

- Chart 1 – 2x Leverage = 538.3%

- Chart 2 – 5x Leverage = -$57,326 Loss

- Chart 3 – 10x Leverage = -$648,826 Loss

This example shows how using leverage can be HIGHLY RISKY!

The 23.75% drawdown caused the total loss of -$57,326 with 5x Leverage, and with 10x Leverage, a total loss of -$648,826 beneath the initial account value.

Circular 3 Real-Time Forex Trading Results (Manually Applied)

Summary: 1732% in 5 Months Using 100x Leverage

Following is a set of account records demonstrating the results of actual real time trading using the Circular 3 algorithm. This is the most advanced tool presented in this series, which is specifically developed to project very accurate turning points in both price and time. The Circular 3 algorithm is so exact that 3 out of 10 times it hits BOTH price and time EXACTLY! When it is not exact, another 4 of these times it is within 5% of the turning point in price and time. The final 3 occurrences fall farther out than this and are considered misses.

When the algorithms perform with this level of accuracy, the leverage can be jacked up to extreme levels, like those used by W. D. Gann to produce the returns that he is so famous for. In the real-time trading records below, you will see that the account began with a mere 1000 Swiss Franc value, and was traded using 100 times leverage. Because of the precise accuracy of these projections, this massive leverage could be applied, using a stop loss in the currency markets of only 1 pip. Using this strategy, the Circular 3, which was NOT automated at that time, but was being traded manually, was able to produce a 1732% return in 5 months, turning a 1000 CHF account into 18324.38 CHF, a 4156.8% Annualized Return.

On the 9th of May, just before the trade that made 3233.42 CHF there was an even 1000 CHF in the account.

Adding up all the P/L in the far right column we get 18324.38 CHF by the end of October, a 1732% profit on initial capital in 5 months.

These are the actual account records showing every trade in the sequence which produced this return. To see the types of turning points that were being identified by the Circular 3 algorithm, simply look back to the Forex charts for those currencies traded back at that time.

Price & Ordering

0

| |

|

144 Pages

Edition not known Edition not known

$3,000.00 (New Hardcover)

Discount Price: $1,200.00 NEW - We are slashing our prices!! New Pricing on ALL Older Books! 50%-75% Off Our Classic Titles! The intent of this course is to present, for the first time, the true meaning and mechanics of the Squaring of Price & Time. It will provide absolute proof that the financial markets are mathematically controlled and predictable. It will demonstrate that ALL market movement can be categorized into only 9 possible binary cases that will exist in any type of vibrational chart. Because

Similar Books by Category

4th Dimension | Baumring Financial List | Chart Analysis | Commodity Trading | CosmoEconomics | Cosmology | Day Trading | Dr. Jerome Baumring | Forex Trading | Gann Theory | Geometry | Grain Trading | Law of Vibration | Market Forecasting | Market Geometry | Market Science | Market Software | Market Timing | Mathematics | Natural Order | Physics | Space-time | Speculation | Stock Trading | Swing Trading | Technical Analysis | Time | Trading Courses | Trading Strategy | Trading Systems | Electro-Magnetism | Applied Gann Theory | Forecasting Services | Position Trading | Baumring Reading List | Market Barometers | Science of Vibration

| |

Related Pages

About Catalin Plapcianu

Plapcianu Courses

Plapcianu Forums

Related Articles & Pages