2015 Prandelli PFS Stock Forecast Bulletin Results A Summary of the Results of Daniele Prandelli's

2015 Forecasts Updates for the S&P500, DAX30, Russell 2000, & Crude Oil

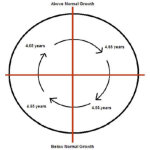

The 2015 S&P Bulletin has been correct over the last year, giving us the opportunity to make new good profits. First of all, let's look at the PFS forecasting model and what I said in October 2014, when I prepared the Bulletin:

It is evident how the Forecast Model suggests a very positive year, with the Low of the year at the beginning and the High of the year at the end. I strongly agree with this view.

I see a general uptrend all through 2015. The general path is:

- A Low in January

- Possible intermediate High in February or March

- A new intermediate Low in March. This Low should not be under the January Low, but it can be, and this is not a big deal, in any case.

- March is a month where to buy.

- The general uptrend should go on till July, where it is possible we see a stop of the uptrend.

- Little descent till August or September, and then up again.

- October, in any case, if it is a Low or if it is pushing toward new High, should be a month to accumulate because from here a new up push should work till the end of the year.

This is the Market till today, 20th of October 2015, and the only "mistake" was the call of the little descent till August or September, only because the descent was not a little one, but it was actually a huge crash, something due to exceptional external conditions, which are hard to forecast, in my opinion (experience proves that I'm right).

I think the chart explains everything. Like I said, you can call the forecast of a little descent from July till August a mistake, but honestly, it is hard to call it a mistake since we said it would go down and it did go down, just more than we anticipated. But as a swing trader, which is how we trade, you would have been short due to this indication, and would have made amazing profits!

During the year, I sent out 3 updates, which were really not necessary since the forecast worked so well throughout the year. I primarily sent the updates to give the Key Price Levels as the market changed trading levels.

The following comments come from the first update I sent in January, where I spoke about other Indexes like the DAX30 and the S&P/ASX200. Here is what I said:

There is also a huge difference between the S&P500 and other Markets like the Russell 2000, the S&P/ASX200 and the DAX30, and I think it is worth paying attention to them as well because the last three have some in common and they can help us to trade the S&P500. What do they have in common? In the last year they made tops at the same level, forming a kind of a sideways movement blocked by a precise resistance level. Don't undervalue the correlation between different Stock Markets because this is an analysis that gives us more data to work with. Let's take a look at the Charts:

DAX30 Index

The Dax30 made a double top around area 10050 points. A break above it would be a confirmation of a new uptrend but if it is not able to move above it, we remain in a dangerous position.

Russell 2000

We see the Triple Top in the area of 1215, a consolidation above it would be the signal of a new uptrend.

S&P/ASX200

We don't see here a clear resistance level, but in the area of 5550 there is a possible top zone, and we can see also a head & shoulder pattern. If the S&P/ASX200 fails the bearish pattern and it moves above the High of 2014, probably a new uptrend can start.

Here is what happened:

The break above the level 10050 has been the trigger for an unbelievable up push!

About the S&P/ASX 200, here is what I said:

We don't see here a clear resistance, but in the area of 5550 there is a possible top zone, and we can see also a head & shoulder pattern. If the S&P/ASX200 fails the bearish pattern and it moves above the High of 2014, probably a new uptrend can start.

What a great up push, again above the level we suggested to pay attention to! If you traded these two Markets, you probably did even better than with the S&P500.

Crude Oil

We also sent out our study about Crude Oil, in January we said:

The trend is down! If you want to trade anyway, follow it, if you want to open LONG positions, do it only when you have a clear signal from the Market and not from any forecasting tool! At the beginning I was forecasting a Low in October, then at the end of November, then around mid-December but the price is the only real thing! What are the best signals? If Crude Oil breaks out downward trend lines, this is the first signal, then if Crude Oil moves above previous Highs we have another signal, since August, the Market never broke previous Highs. Another signal then is to use long-term levels. My Long Term Price Levels are at 38, then 57.40 and then 74.

Look at the Chart of Crude Oil right now, the Low was at 38, a great price study! In our Daily Report Service we are LONG from 38!

This little review of the 2015 S&P500 Bulletin should be enough to show you how we work. For the last 2 years our forecasts have been accurate like this, and we are now releasing our new PFS report for the S&P500 for 2016.

Related Pages

Daniele Prandelli Ė†Author Information

Prandelli Courses

Forecasting Examples

Prandelli Forums